While some are taking delight in Justin's passing, the pond is taking delight in Uncle Leon, getting more deeply weird and extreme by the day, radicalised by his own site and whatever he's been ingesting.

Lately Uncle Leon has been making plans for Nigel, as in Daniel Boffey in the Graudian's Bromance on the rocks: where does Musk’s brush-off leave Nigel Farage?, The Reform leader’s dalliance with the US billionaire looks in trouble after an abrupt about-turn from the X boss, with Zoe Williams providing commentary in Elon Musk loves to provoke – and Nigel Farage is his latest victim.

Uncle Leon also loves to be provoked, as detailed in Elon Musk Cusses Out Student Who Called Him a Fake News Machine.

“Elon Musk is rapidly becoming the largest spreader of disinformation in human history, hijacking political debates in the process,” wrote Joni Askola, a Finnish graduate student and activist for defense of Ukraine. “The EU must take action!”

“F u retard,” came Musk’s response, containing a slur used against people who have mental disabilities. He then replied saying “yes” to another person who said: “We could have avoided a lot of disasters by simply telling leftist retards to stfu.”

Musk appears to have made a conscious choice to reintroduce the word into right-wing parlance of late, often using it on his X platform.

An analysis of his X posts and replies shows that he has used the term or a variant of it 15 times since Dec. 20, having never used it before that.

Deeply weird, and with endless speculation about that relationship, as in Trump Privately Complains About Clingy Elon Musk: NYT Reporter.

Thought for the day: be wary of the letter X and ketamine.

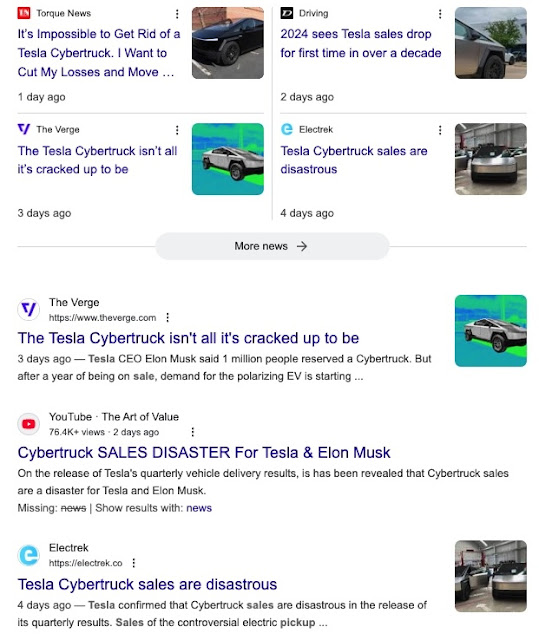

Meanwhile, there have been all sorts of stories about Uncle Leon's truck, and not just the one that blew up ... there are the ones where punters are thinking about writing off their $2,500 deposit as a better bet than being stuck with a lemon ...

The Verge story The Tesla Cybertruck isn’t all it’s cracked up to be / ‘It hasn’t become a large volume competitor.’ is typical of a very competitive and crowded field.

Meanwhile, Tesla share prices are in a state of flux - on the one hand, Tesla shares fall as company reports first decline in annual deliveries and Tesla Stock Is Down As Shipments Fall And Rivals Keep Up Pressure; on the other hand, Tesla Stock Rises. Selling Cars Is Now Less Important Than This., Investors wiped out all of Thursday’s losses with a big Friday gain, showing that current sales numbers aren’t what’s driving the stock.

It seems that selling unicorns with an AI horn, and idle talk of futurist cab services and such like is enough to sway speculators to speculate.

The pond mentions all this, because this day is economics day at the lizard Oz.

Sure, Justin dominated the front digital page ...

.

Sure Justin was at the top over in the far extreme right of the digital edition, celebrated by a lesser member of the Kelly gang ...

But mostly pundits were being exceptionally productive.

Dame Groan, in her usual way, led with US has productivity lessons for Australia, We’re not the only country facing low or negative productivity, but we need to work out why, which the reptiles assured the pond was a tedious five minute read, an exceptional effort by the groaner.

It began with a snap of the newly appointed redeemer, US president-elect Donald Trump. Picture: Getty Images

Dame Groan was inspired - not for her any Krugman-style talk of The Dollar and the Trade Deficit, What will Trump do when his favourite obsession goes the wrong way?

She was all in on the tangerine tyrant and a productive future for all:

Up until that point, it was an article of faith that there was a trade-off between inflation and unemployment. A government could dial down the rate of inflation by accepting a slightly higher unemployment rate. By the same token, a lower rate of unemployment could be achieved by living with higher inflation. (It’s what economists call an exploitable Phillips curve.)

If the collapse in the relationship had only involved a new name, then it would have been neither here nor there. But the breakdown was critical to fracturing the belief in the Keynesian model of active demand management by government, even if it took many years for the message to be widely accepted. (Arguably, belief in the Keynesian model continues to influence bureaucratic thinking to this day, including in Australia.)

While it’s common these days to parody Paul Keating’s comment about the early 1990s – “it’s the recession we had to have” – the real intent of his statement is generally overlooked. The point he was making was that it was necessary to stamp out persistently high rates of inflation to enable the economy to reset on a sustainably productive basis.

Keating understood that the suite of supply-side reforms that had been enacted – think financial deregulation, removal of high tariffs, sale of government businesses, labour market reforms – would pay strong dividends over time.

The pond loves the way that retrospectively the reptiles fell in love with the French clock man.

At one time his tendency to fly over the dead heart on his way to Paris produced reptile outrage, these days he's rewarded with a caring, convivial snap, Former prime minister and treasurer Paul Keating. Picture: John Feder

Meanwhile, Dame Groan kept herself busy trolling pond correspondents:

If we fast-forward to this year, it may be time for a new term to describe what is an unexpected set of economic features – full employment, low economic growth, above-target underlying inflation, falling productivity and negative growth in per capita GDP. The term “per capita recession” is now widely used – a recession is defined as two successive quarters of negative GDP growth – but this doesn’t fully capture what is going on.

In order to unravel this puzzling bundle of characteristics, it’s worth reviewing what has been going on, including the government’s response to Covid and the aftermath.

A core issue is the slump in productivity, with the level of productivity now only at that achieved in 2016. According to the National Accounts, labour productivity fell by a massive 1.9 per cent in the year ending in the September quarter of 2023 and by 0.8 per cent in the year ending in the September quarter of 2024. This is the heart of the problem because productivity growth is the driving force of real wage growth and higher living standards. Unless we can understand why productivity in Australia is in the doldrums, we are incapable of devising appropriate policy responses.

To be sure, several other advanced economies have also experienced low or negative growth in productivity. But here’s the thing: the US is a standout when it comes to productivity growth, with the gap between average productivity in Australia and the US increasing over the past decade or so. The growth in labour productivity in the US has been 10 times higher than in Australia over the past 10 years, certainly on the raw figures.

James Thiris, senior research economist at the Productivity Commission, has taken a look at this “great productivity divide”, making the point that the two countries have slightly different approaches to measuring productivity and these differences should be taken into account.

The US figures focus on “the non-farm business sector”, which excludes the non-market sector, including education, healthcare and aged care. This non-market sector is largely funded by government and is known to be less productive than the market sector. Mining productivity also is much more volatile than in the rest of the economy.

Adjusting for these differences reduces the productivity gap between the two countries by about 20 per cent. But as Thiris concludes: “Even so, a sizeable gap still remains.”

When ever anyone talks about sizeable gaps, the pond is always reminded of Dr Strangelove: ...we must be increasingly on the alert to prevent them taking over other mine shafts space, in order to breed more prodigiously than we do. Thus, knocking us out of these superior numbers when we emerge! Mr. President, we must not allow a mine-shaft gap!

The reptiles managed this snap to show the sizeable gap, There is a ‘great productivity divide’ between the US and Australia. Picture: Getty Images

What on earth did that image mean? What was it intended to conjure up? A crowd in a street evokes a great productivity divide? Is that the result of a mine-shaft gap?

The pond is inclined to note that the United States at the moment seems like a country that is deeply divided and deeply unhappy.

There seems to be a lot of divides going down, divides that are likely to get worse when King Donald I begins his reign.

Dame Groan would have none of it ...

The strong surge in new entrants into the Australian labour market – much stronger than in the US – has also meant a relative glut of inexperienced, low-productivity workers. Over time, this effect may subside as workers acquire work-related skills and begin to hit their full potential.

Politicians often fall back on investment in education and training as a way of improving productivity. The reality is that the evidence on this link is unclear.

After all, there has been a significant ramp-up in the number of university graduates in Australia but productivity has not risen in tandem. In fact, the proportion of 25-34-year-olds with a post-secondary degree in Australia is higher (56 per cent) than in the US (51 per cent).

Another way of looking at the productivity gap between the two countries is to think about what has been happening in the US and to draw comparisons with Australia. There are some very noticeable differences in the two economies that are important to understanding the divergence in productivity growth. These include capital investment, energy prices, technology, a flexible labour market, and taxation arrangements. These factors are interlinked.

Take energy prices, for instance. They are significantly lower in the US compared with Australia. For instance, the price of natural gas in the US is close to 80 per cent lower than on Australia’s east coast.

Electricity prices are lower in the US, particularly in certain states. For energy-intensive enterprises, this environment is very attractive.

Technology is clearly playing an important role in driving productivity in the US – think Silicon Valley, AI and data centres. The combination of patient capital, huge rewards for success, and acceptance of failure contribute to the development and take-up of new technologies.

By contrast, Australia has lost its way when it comes to fostering productivity growth. There is a naive belief that the GDP can be divided up in different ways without affecting its growth.

In particular, the Labor government has sought to increase the labour share, in part by mandating or funding higher wages, and boosted government spending assuming neither would damage productivity or per capita incomes.

The economic impact of the hyper-regulation of industrial relations introduced by Labor is downplayed. Having large migrant intakes has led to a capital shallowing that has had a negative effect on productivity.

With the election of Donald Trump, there is a real possibility that the gap in productivity between the two countries could further diverge. We must be prepared to learn the lessons.

The lesson the pond learned? Always hedge your bets.

Spend lots of time and words blathering away in an exceptionally productive way about productivity and gaps, and then when it comes to the crunch, allow yourself an out, "there is a real possibility", so if anyone bothers to look back, you can always say, oh it was only a possibility, and possibly it went the other way ...

And so to an economics bonus. This one comes from Dimitri and a sidekick.

The pond has noted Dimitri before, more commonly known as a member of the Speccie mob, where he has also consorted with his sidekick, Peter Swan.

A favourite theme is the Kommissars of Kanberra, which offers a little irony, given that Dimitri once paraded as a "former government policy analyst".

What the pond liked about Dimitri was the way he installed himself in a suburban house, 37 O'Connor Street Haberfield, gave his company name a fancy title, Eminence Advisory, dubbed himself a principal, and wandered forth into the world, and began letting off steam, as in The moral hazards of Canberra’s big government project,Without foundational changes to the Australian federation, all levels of government will likely continue to be inefficient.

The team of Burshtein and Swan began with a snap of the heroic Petey boy, Former Treasurer Peter Costello Picture: Jane Dempster/The Australian.

The pond was still trying to work out what the notion of 'moral hazard' had to do with it all. Enlightenment failed to follow ...

Unfortunately, Australia’s current political and bureaucratic landscape is so deeply impaired that meaningful and constructive reform of any kind seems improbable in the foreseeable future.

Just as politics is shaped by culture, economic reform requires institutional and structural changes. Without significant reforms within the bureaucracy, there will be no effective counterbalance to the increasing size and sloth of government. Likewise, without foundational changes to the Australian federation, particularly in the dynamics of commonwealth-state and territory relations, all levels of government are likely to persist in their expansion and inefficiency.

Recently, former treasurer Peter Costello lamented that “You cannot rely on the Treasury any more to try and defend taxpayers … they’ve thrown in their lot with this big government, big spend”.

It is difficult to disagree with such an observation given data showing the uncontrolled and unconscionable rise in the size of government in Australia, financed by a rising share of the economy confiscated through taxes.

Indeed, indeed, if everyone in government would just get themselves a suburban house and a grand pooh-bah title, how much better things would be.

As a side benefit, the reptiles could slip in a little AV distraction, cross promoting Sky Noise

Sky News host James Morrow slams Treasurer Jim Chalmers for announcing major changes to the investment mandate of Australia’s $230 billion Future Fund to direct funds to Labor’s agenda. The move has directed funds to prioritise investments in housing, renewable energy and infrastructure. “Just on this future fund business, it is absolutely disgraceful this money it was put aside it was created by John Howard chaired by Peter Costello very recently to provide the money for public service salaries, you know, public service pensions,” Mr Morrow said. “That Treasurer is Jim Chalmer - he is going to squander, absolutely squander, the legacy of 20-plus years of good governance.”

This was extremely productive, inspiring the pair of scribblers to a bout of peak productivity, splendidly designed to troll pond correspondents:

To the recent generations of Australian politicians and policy boffins, the word reform has come to be an adjective rather than a verb.

Costello additionally warned that the “rigour” within the Treasury had “declined considerably”. But what has not “declined considerably” within the Treasury is the remuneration of its secretaries and executives.

Over the same 20 years that Australian government has undergone its slothful expansion, the annual salary of the Treasury secretary has increased from $465,000 to $960,000. This is an average annual increase of 5.3 per cent, well exceeding both inflation and economic growth.

This misalignment of remuneration and results seems to validate the observation of Thomas Sowell that “it is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong”.

More so in the hands of people who are actually rewarded when they are wrong.

Why advocate for constraint or important reforms when your remuneration is untethered from economic growth and productivity?

But Australia’s growing economic rot is not just institutional. It is also structural, with the effective dismemberment of the Australia Federation.

Where once Australian states and territories were “laboratories of democracy” that could experiment with policies and solutions to address various issues, the decentralisation of borrowing powers coupled with the centralisation of taxing and policy in Canberra has created the mother of moral hazards, incentivising economic irresponsibility across all tiers of government.

Before 1994, the commonwealth set strict annual borrowing limits for state and territory governments. That year, however, the Keating government “reformed” the Loan Council to better align with (what was then) the federalist structure of Australian government.

In doing so, the commonwealth relinquished its power to borrow on behalf of the states. The states would henceforth be accountable to financial markets rather than the commonwealth for their borrowing and financial (mis)management.

Unknown at the time were subsequent legal and policy decisions that today expose all Australian taxpayers to the fiscal and economic ineptitude of Australian governments.

In 1997, in the landmark Ha vs New South Wales case, the High Court of Australia determined that alcohol and tobacco taxes were excises and as such the constitutional provenance of the commonwealth. This decision punched a significant hole in the fiscal wall between the states and Commonwealth. Then in 2000, in a near complete demolition of the fiscal wall, the introduction of the GST transferred a further giant swath of state revenues to the commonwealth.

Today, the commonwealth collects more than 80 per cent of all taxes in Australia. And with this control over the vast rivers of tax revenue, the commonwealth not only started to grow in relative size but started to increasingly meddle in the affairs of the states and territories using the carrot and stick of commonwealth funding.

The outcome has been a disastrous big government and anti-productivity project run out of Canberra that has centralised, standardised, and bureaucratised policy and wrung out any vestiges of policy innovation and tax competition. Consider, for example, education, where despite not operating a single school, the federal Department of Education today employs 1700 people, including 10 based overseas, and has an annual operating budget of more than $370m.

Indeed, indeed, if they just shifted the entire department into a house in Haberfield, think how much better things might be.

At this point, the reptiles interrupted with a snap of another hero, the lying rodent, Still of John Howard in a Labor Party television commercial on GST for the 2001 election.

Then there was time for a final message:

This is why Northern Territory residents received $5.06 for every dollar of GST collected in the Territory compared to NSW residents, who received $0.87 for every dollar of GST collected in their state.

The surrender of influence over state debt by the commonwealth, coupled with the dominance of tax collection at the commonwealth level, further overlaid with horizontal fiscal equalisation, has removed key incentives for fiscal constraint. A likely factor why among all the forms of reform proposed, nary a word is said about spending reform or government efficiency.

Federation and institutional reform are a necessary precondition for all other reforms. Don’t listen to us. Listen to Sir Humphrey Appleby who accurately observed: “The public doesn’t know anything about wasting government money. We (government) are the experts.”

Strangely, all this unproductive ranting about productivity plunged the pond into a deep fit of nostalgia, remembering the glorious days when tea ladies (they always seemed to be ladies) wandered around the ABC with a large urn on a trolley, dispensing tea and little biccie treats.

What a glorious, golden time. These days, it seems, you're lucky if you get to piss in a bottle so that Uncle Leon can keep up his ketamine supply...

Never mind, credit where 'Speccie mob visits the lizard Oz' credit is due ...

Dimitri Burshtein is a principal at Eminency Advisory; Peter Swan is professor of finance at the UNSW-Sydney Business School.

"not for her any Krugman-style talk..." No, I guess not, since The Krug says: "my year in government certainly taught me never to assume that senior officials have any idea what they’re talking about." And that would about cover it for the Groany, yes ?

ReplyDeleteAn interseting point to Dame Groan how she by passed 2007,08 and when the world was put into a tail spin because of what happend to the US economy.

ReplyDeleteBut, butt Anony, who was running the US at the time ? Hint: he was the one after Bill Clinton and before Barack Obama. Now had it been either of them running things, she'd have screamed from the mountains and valleys about the incompetence of such as they.

DeleteBut they weren't, so no mention of gross failures.

Hmmm: "...quest to understand not human nature but my own nature". Well when you do figure it all out, let us know; we're just a little bit curious too.

ReplyDelete"the reptiles fell in love with the French clock man". But, BG, butt he (and the lesser Hawke) is a fundamentalist econorat which they didn't understand or recognise at the time. But hey, after nearly a decade of it, they finally cottoned on to the 'privatise everything' line that Keating and Hawke were running with. Which they had indeed picked up from that remarkable man Jeff Kennett (which is part of the reason why Victoria is in deep doggies now).

ReplyDeleteGood grief GB ! Did I actually post that? Just call me Sancho and Sisypus too but it's good exercise, tilting at windmills and rolling rocks.

ReplyDeleteSome things certainly haven’t changed with the New Year - it’s a typical whinge-fest from the Groaner, all complains and zero constructive suggestions. Not surprisingly she’s full of praise for the economic management of former Treasurer Peter the Gutless Wonder; yes, what could better exemplify sound economic management than taking the. Proceeds of the resources book and pissing it up against the wall; that’s “productivity” for you.

ReplyDeleteIi was a little concerned that the Dame might have forgotten to include her usual dig at bloody foreigners, but she managed to get it in eventually, albeit as a fairly minor point. Can we assume that she’ll be cheering God-Emperor Donald I on when he commences his attempt to boot out several million essential workers, and calling for a similar approach here? That should do wonders for “productivity”.

How much time and effort does it take to produce nothing ? Zero and zero, basically, so the productivity is thus 0/0 which is, of course, indeterminate.

DeleteIn flailing about to fill a columns for this day, our Dame Groan might have taken up the Abbott ‘shoulda, coulda, woulda’ mindset.

ReplyDeleteShe was a Commissioner on the Productivity Commission, but left no traces of any personal input to advancing productivity in our land of Girtby. Neither has she shown any subsequent sign that others revealed to her what was likely to improve productivity. In retrospect, until recently, pronouncements from that Commission were along the lines ‘productivity should be better, and ‘aorta’ should do something about it.’

Gas prices are high? Back when Alan Bond was trying to take over our then largest producer, News Limited did not oppose Hugh Hudson’s requirement that SANTOS under Bond’s direction should hold a substantial reserve of gas for domestic demand. After all, Bondy was a virtual buccaneer, not a proper business type of the old Adelaide grouping. Unfortunately, as the Bond bid wilted, the domestic reserve evaporated with it. Subsequent SANTOS boards - including our Dame - presumably saw their duties fulfilled by seeking the highest price for that gas, wherever it might be found. Oh, and oppose in every way any hint of the wicked socialists trying to extract a reasonable resource rent from the profits.

Our Dame has the usual fanciful notion of how industry functions for our cousins across the waters. ‘Silicon Valley’ is no longer an appropriate metonym for the current growth sectors for electronics in the USA. That it is not, also shows how little strategic thinking and planning the US-based industry has done. The chips that process AI ad its likely offshoots come from - Taiwan. Has private enterprise in the USA been reducing risk of interruption, our outright termination, of supply of those chips? Not really. It has been the Biden administration that has promoted construction of factories, on US soil, to make those chips. It will be for the next administration to complete the buildings, and recruit the technicians to work in them. Of course, those technicians must be the offspring of US citizens, going back several generations.

It was not a serious thought that our Dame would revisit her own time as a director of commissions and corporations which have produced many of the circumstances to which she now points as possible factors in low growth in productivity here. In retrospect, it seems that, not only did she gain nothing from her time on the Productivity Commission, but she gave nothing to it. I cannot recall her ever writing for Rupert that a better national effort to improve all aspects of labour, as an essential factor in production, was quite likely to deliver a steady gan in productivity - and here is the evidence from the Dame’s time as a researcher in South Australia.

At least Groany does appear to have begun to grasp the idea that there is a significant difference between 'market' (mainly manufacturing) and non-market (mainly service) enterprises. So it really isn't too much of a stretch to grasp that say a doctor's 'productivity' or a tram driver's 'productivity' or a musician's 'productivity' is not quite the same thing as mass production worker's 'productivity' and can't even begin to be measured in the same way. Besides when the Australian automotive (mass production car manufacture) industry was closed down by the LNP, we lost a significantly 'high productivity' activity which was never replaced.

DeleteSo to be only about 20% behind the USA overall is pretty good, yes ? But then, how can we improve, for instance, a tram driver's 'productivity'? Oh I know, bigger trams which fit more people into a tram journey ! Provided that there is a lot more people wanting to travel on each tram over a day. Right, immigration ! The more people we have, then the more people will want to ride in trams thus increasing the tram driver's productivity markedly. Problem solved.

"An analysis of his X posts and replies shows that he has used the term or a variant of it 15 times since Dec. 20, having never used it before that."

ReplyDeleteUncle Leon's mum called on Dec 20, from China, invoking The Manchurian Candidate cascade.